An In-Depth Guide to Sandwich Attacks in DeFi

How Jaredfromsubway.eth front-run the entirety of Uniswap

Introduction to Sandwich Attacks in DeFi

Decentralized Finance (DeFi) has experienced exponential growth in recent years. As with any innovative technology, it has its fair share of challenges.

One of these challenges is the so-called sandwich attack. In this article, we'll dive into sandwich attacks in DeFi, how they occur, their impacts, and measures to prevent them.

A brief overview of Defi

Decentralized Finance, or DeFi for short, is a rapidly growing sector in the cryptocurrency and blockchain space.

DeFi is an umbrella term for financial services and applications that operate on decentralized platforms, primarily utilizing Ethereum and its smart contracts.

The core idea behind DeFi is to remove intermediaries, such as banks and other traditional financial institutions, and provide users with direct access to financial services.

Before we delve into what or how a sandwich attack works, we’ll need to understand the fundamentals of DeFi Transactions.

How DeFi Transactions Work

To understand sandwich attacks, you must first grasp how DeFi transactions work. The two main aspects of DeFi transactions are on-chain transactions and smart contracts.

On-chain Transactions

On-chain transactions are those that occur on the blockchain. When you interact with a decentralized application (dApp) or a decentralized exchange (DEX), your transaction is added to the blockchain and executed by miners or validators.

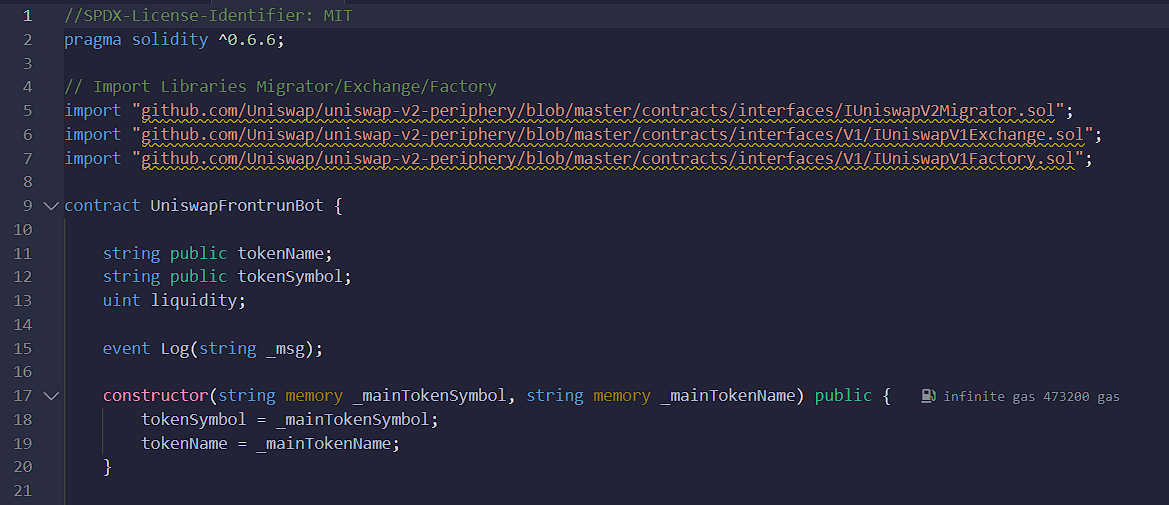

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code.

They control most DeFi applications and execute transactions based on predefined conditions.

How Sandwich Attacks Occur

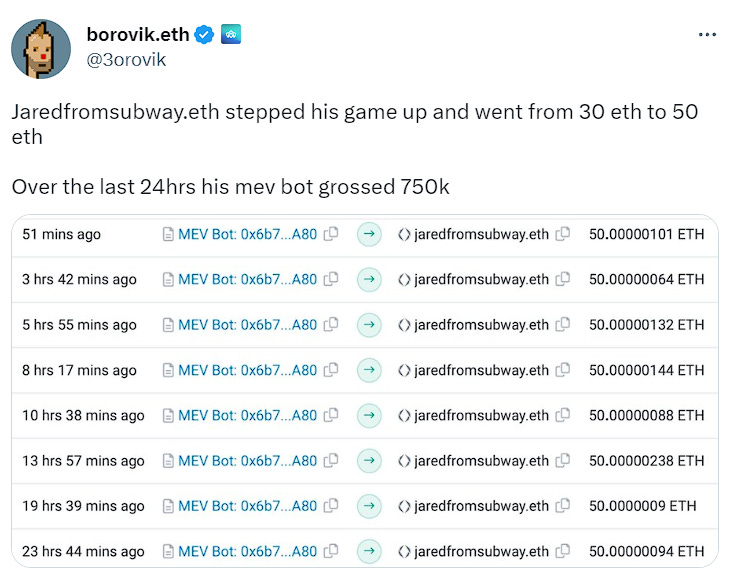

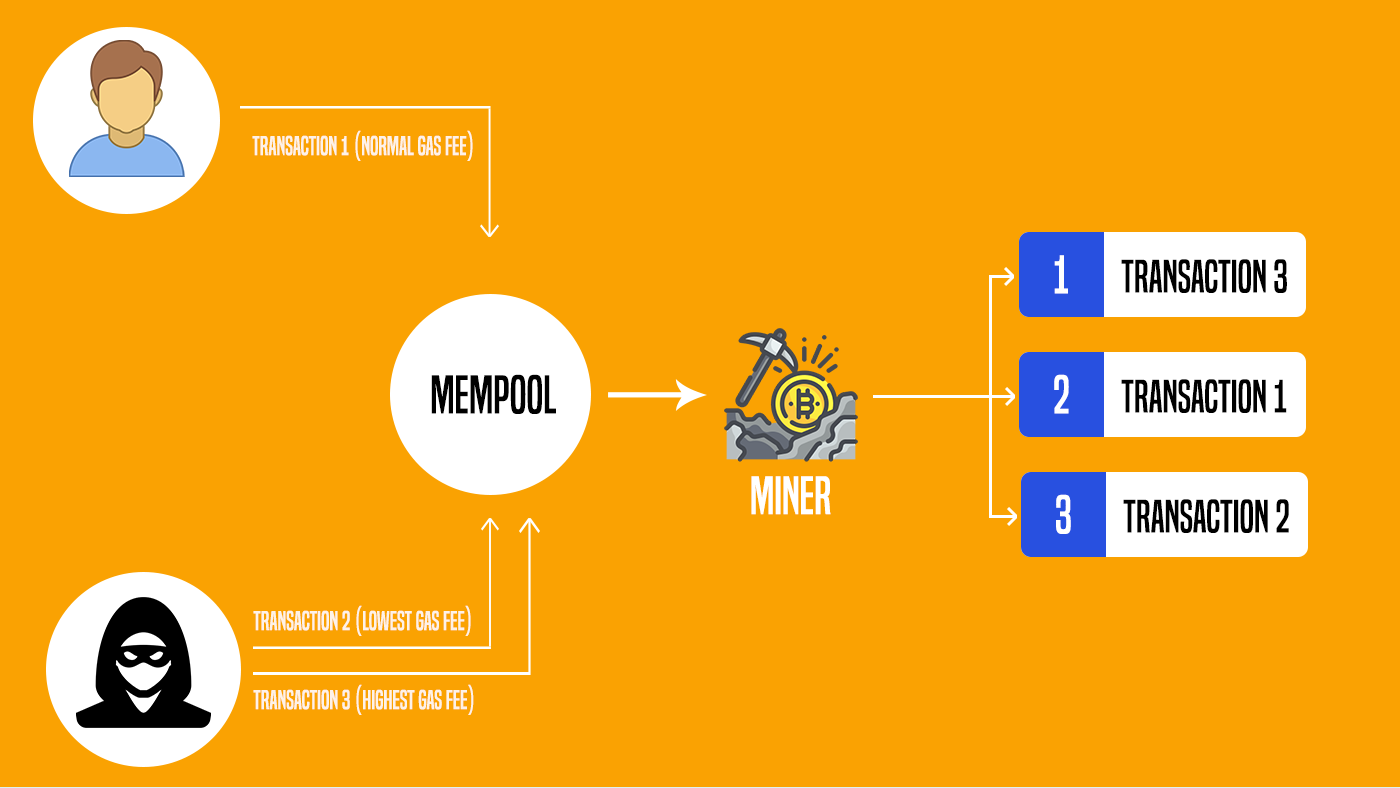

Sandwich attacks occur when an attacker manipulates the order of transactions to benefit from the price movement caused by a user's trade. This can be done through front-running and back-running.

Front-Running

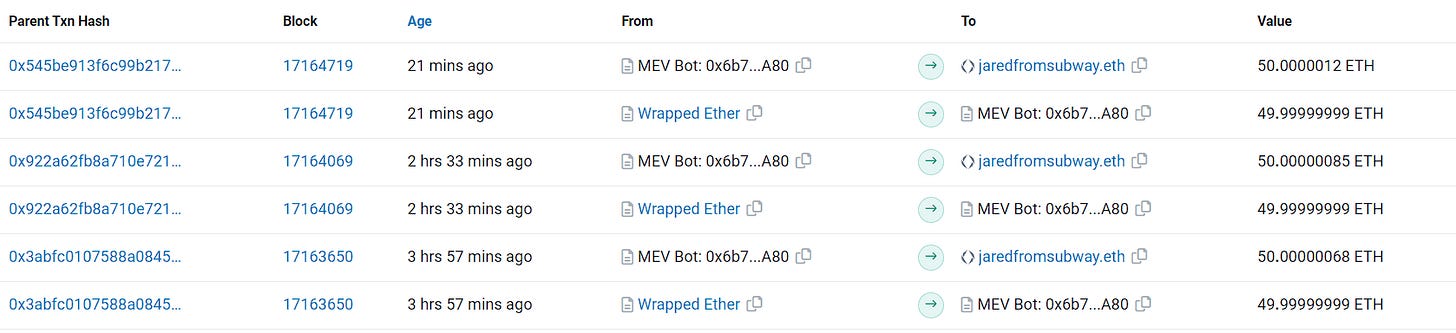

Front-running is when an attacker spots a user's transaction in the mempool (the pool of pending transactions) and creates their own transaction with a higher gas price.

This ensures that the attacker's transaction is executed before the user's, allowing them to profit from the price change.

Back-Running

Back-running is when an attacker places a transaction immediately after the user's transaction.

The attacker benefits from the price change caused by the user's trade and sells immediately after, making a profit.

Impacts of Sandwich Attacks

Sandwich attacks have several consequences, including user financial losses and market manipulation.

Financial Losses for Users

Users can suffer significant financial losses due to sandwich attacks.

As attackers manipulate the transaction order, the user pays a higher price for their trade, which translates to financial losses.

Market Manipulation

Sandwich attacks contribute to market manipulation, allowing attackers to influence the price of assets in the short term.

This manipulation undermines the fairness and trust of the DeFi ecosystem.

Examples of Sandwich Attacks in DeFi

There have been several high-profile sandwich attacks in the DeFi space. In one instance, a user lost over $100,000 due to a sandwich attack on the SushiSwap DEX.

In another case, a user lost approximately $50,000 while trading on the Uniswap platform.

Measures to Prevent Sandwich Attacks

There are several ways to mitigate the risk of sandwich attacks in the DeFi ecosystem:

Slippage Tolerance

Users can set a slippage tolerance level in their transactions, which limits the maximum price change they're willing to accept. This can help protect users from severe price manipulation during sandwich attacks.

Gas Price Manipulation

Users can increase their gas prices to ensure their transactions are executed faster.

This makes it more difficult for attackers to front-run their transactions. However, this method could lead to higher transaction costs for users.

Time-locked Transactions

Some platforms offer time-locked transactions, which allow users to set a specific time or block number for their transactions to be executed.

This feature can make it harder for attackers to sandwich the user's transaction.

Decentralized Exchanges with Order Books

Users can opt for decentralized exchanges that utilize order books rather than automated market makers (AMMs).

Order book-based exchanges are less susceptible to sandwich attacks, as they provide more transparency and control over the execution of trades.

Conclusion

Crypto sandwich attacks pose a significant threat to the cryptocurrency ecosystem, exploiting vulnerabilities in the trading process to the advantage of malicious actors.

Understanding how these attacks work and implementing preventive measures is crucial for protecting individual investors and the overall market stability.

The cryptocurrency community can strive towards a more secure and resilient trading environment by staying vigilant and adopting security best practices.

Manage your Cryptocurrency News & Information all in one place

Alphaday is the ultimate crypto dashboard for staying up to date with all things crypto and interacting with your favorite DApps.

It is built on a highly customizable platform that lets you re-create your entire crypto workflow within minutes, so you never have to visit another crypto website ever again.

Our mission is to bring you all the tools needed to follow your favorite projects, stay up-to-date with the latest narratives, and use your favorite dapps, all from the comfort of one easy-to-use customizable dashboard.