Cryptocurrency has become one of the hottest topics in the finance world, with millions of investors getting into the game every year. While investing in cryptocurrencies like Bitcoin, Ethereum, and Dogecoin has much potential, it also comes with its own set of challenges, such as dealing with tax implications.

Plus, if you've invested in cryptocurrency, you may have to make multiple transactions throughout the year, and keeping track of them can be challenging. Fortunately, there's a solution - cryptocurrency tax software.

In this article, let’s explore the best crypto tax software you can use in 2023.

Without further ado, let’s dive in.

What Is Crypto Tax Software?

Different jurisdictions have different tax laws that apply to cryptocurrencies. Crypto tax software automatically syncs your wallets and exchanges, computes your capital gains and losses, and generates final tax reports that can be used to file your taxes.

Accurate transaction reporting can be facilitated using crypto tax software to avoid fines or other repercussions. It also locates prospective deductions while maximizing your tax burden and ensuring you pay the right amount while utilizing available tax benefits.

Crypto Tax Software: How Does It Work?

Crypto tax software integrates with your exchanges and wallets, making tracking and computing your crypto profits and losses easier. Here's a brief overview of how it works:

Integration: The software securely accesses your transaction data by connecting to your wallets and exchanges with API keys or CSV files.

Obtaining data: It imports the history of all your transactions, including trades, deposits, withdrawals, and other actions.

Calculating profits and losses: It accounts for tax events like airdrops, staking rewards, and mining income when calculating your profits and losses based on parameters like purchase costs, disposal proceeds, and holding period.

Tax reports: It generates tax reports that are specifically suited for your jurisdiction, with information on total profits and losses, taxable income, and any required forms or schedules.

Tax Filing Requirements for Crypto Investors

Once you have selected the appropriate crypto tax software, you will need to provide the necessary information to prepare your tax forms accurately. When it comes to cryptocurrency tax filing, there are certain things to keep in mind. Here are some of the requirements that you must fulfill:

Record all transactions: To report your cryptocurrency trades, you must keep track of all transactions. The crypto tax software automatically syncs with your wallets and exchanges and provides you with a complete record of all your transactions.

Identify gains and losses: Based on the transaction history, the software can identify all your capital gains and losses. The software takes into account all factors such as purchase costs, disposal proceeds, and holding period to determine your profits and losses.

Report taxable income: Crypto gains are taxed the same as ordinary income if held for less than a year. For assets held for more than a year, long-term capital gains tax applies, which is typically lower. Crypto tax software helps you report your taxable income accurately.

Report additional income: If you have received any additional income, such as staking rewards or airdrops, you must report it as taxable income.

Report fees and commissions: Fees and commissions incurred during the trading process can be added to the cost basis of your cryptocurrency. This helps in lowering your gain or raising your loss and ensures that you pay the right amount of taxes.

Choosing the Best Crypto Tax Software

When choosing the best crypto tax software for your needs, there are certain factors that you should consider. Let’s take a look at the key features to look for:

Integration with major exchanges and wallets: The crypto tax software should be able to seamlessly integrate with the major crypto exchanges and wallets to provide you with a complete transaction history.

Support for multiple blockchains: The software should be able to support multiple blockchains and tokens to cater to a variety of cryptocurrency portfolios.

Compliance with tax laws: The software should be compliant with the tax laws of your country or jurisdiction.

Pricing and functionality: The software should offer a good blend of pricing and functionality to ensure the highest return on investment in Bitcoin tax tracking.

Integration with tax preparation software: The software should be able to integrate with well-known tax preparation software to speed up the tax filing process.

Limit on transactions: The software should be able to support a sufficient number of transactions to accommodate users with different portfolio sizes.

Support for NFT and DeFi transactions: The software should be able to support non-fungible token (NFT) and decentralized finance (DeFi) transactions and their tax implications.

Best Crypto Tax Software

CoinLedger

CoinLedger is one the best software for cryptocurrency taxes. This Canada-based tool offers features for tax professionals and tools for NFTs and tax reports.

CoinLedger offers accessibility to both inexperienced investors and professional traders with thousands of transactions with pricing plans ranging from $49 to $299. Trading professionals can keep track of their cryptocurrency assets and NFT tax implications thanks to the uncommon implementation of NFT tracking. For people who generally struggle with tax preparation, the automated aspect of tax report generation delivers a frictionless process.

Pros

CoinLedger supports over 10,000 digital currencies and provides complete historical data. Your crypto accounts can be synced from an unlimited number of crypto exchanges. Throughout the year, the platform displays your profit and loss numbers as well as your tax obligations.

For IRS forms, income tax forms, capital gains tax, and audit trails, there are many excellent resources available.

CoinLedger provides an integrations library, including integrations for Wallet and DeFi.

Cons

The basic plan only allows for 100 cryptocurrency transactions before the monthly fee increases.

TaxBit

TaxBit is a cryptocurrency tax software that was established in 2018 by a group of tax lawyers, CPAs, and software developers. For bigger businesses, governments, and corporate operations in particular, this is a great tax calculator.

Pros

Based on sophisticated algorithms, TaxBit's accounting software and tax calculator are proactive and provide regular real-time insights into your cryptocurrency tax portfolio.

More than 500 sources can have their transactions synced. Additionally, it complies with IFRS and GAAP for cryptocurrencies and digital assets.

You can link your wallets, exchanges, DeFi protocols, and NFTs on an individual basis.

Transaction histories and other tools for past tax forms are also available.

Cons

For larger businesses, this is a better tax calculator, but the features at the individual level may be too complex to handle.

The NFT suite and other tools for optimizing cryptocurrency portfolios are also only available with higher plans.

Koinly

For traders wishing to simplify their crypto tax filing, Koinly is another good option. You can check how much you've invested in cryptocurrencies, receive an overview of your crypto income, and view your realized and unrealized capital gains by synchronizing and importing your data into Koinly.

Pros

Koinly can complete your IRS Form 8949, just like the majority of crypto tax software. However, Koinly also includes Schedule D in your tax report, unlike Accointing and Taxbit.

Unlike its rivals, Koinly accepts payments made using credit or debit cards as well as cryptocurrencies including BTC, ETH, and USDC.

Koinly allows transactions across 400 exchanges and more than 170 blockchains.

Cons

While Koinly offers a free plan that allows you to log up to 10,000 transactions if you want to create any tax reports, you'll need to upgrade to a paid plan.

Accointing

Accointing is another great software for tracking cryptocurrency transactions and filing taxes. While you can use it anywhere in the world, it is optimized for users in the United States, Australia, Germany, Switzerland, and the United Kingdom. In October 2022, the Swiss-based cryptocurrency analysis business Glassnode purchased Accointing.

Pros

Benefits include portfolio tracking and Accointing's ability to keep track of all of your cryptocurrency assets. You can assess your cryptocurrency gains in relation to other cryptocurrency portfolios.

You can also automate price notifications and there are reliable cryptocurrency market charts.

Regarding your cryptocurrency tax calculator, you may utilize Accointing to prepare your cryptocurrency assets' general taxes either on your own or in collaboration with a tax expert. Using various techniques including FIFO, LIFO, and HIFO, you may effortlessly file all of your cryptocurrency tax reports.

Cons

According to several reviews, the customer service from Accointing isn't always the best.

No subscription plan, even the most expensive one, allows for limitless crypto trades.

Coinpanda

Coinpanda lets you generate cryptocurrency tax reports in under 20 minutes. You receive a solitary report with an in-depth breakdown of all your Bitcoin, transactions, and taxable gains.

You receive a thorough overview of your acquisition costs, earnings, and short- and long-term gains for each NFT and cryptocurrency asset you possess in the reports. Coinpanda also lets you produce tax reports according to the regulations of more than 65 nations worldwide.

Pros

Tax reporting that is accurate and quick.

All gifts and misplaced coins are accepted.

International tax reporting.

Import data from more than 800 wallets and exchanges.

Cons

More prompt customer service is required.

ZenLedger

One of the most well-liked Bitcoin tax software alternatives available is ZenLedger. The company was founded in 2017 and is based in Washington. ZenLedger's website states that it wants to "simplify DeFi, NFT, and crypto taxes for investors and tax professionals."

Pros

With the ZenLedger free plan, your only limitations are the fancy premium customer service and some DeFi, staking, and NFT features that are only available with the most expensive edition.

You can utilize HFI, LIFO, and FIFO to complete your tax audit reports, manage your cryptocurrency revenue, donate and mine cryptocurrencies, participate in ICOs and Airdrops, and obtain reliable tax-loss harvesting tools. Due to its ease of use, ZenLedger is a great option for novices.

Cons

Compared to other crypto tax software, the range of tools and prepaid plans for tax experts may fall short for some specialists.

ZenLedger features a free plan with a limit of 25 transactions.

Doesn’t offer a mobile app.

CryptoTaxCalculator

CryptoTaxCalculator is a crypto tax software that complies with IRS regulations. It offers a professional software suite for accountants and bookkeepers and supports hundreds of important US and worldwide exchanges.

Pros

Up to 100,000 transactions are supported, tracked, and reported with CryptoTaxCalculator's Trader plan.

With over 600 exchanges and wallets supported, this cryptocurrency tax software enables rapid and simple import of all your transactions.

CryptoTaxCalculator makes it easy to comply with IRS regulations by providing region-specific report formatting for the US.

Cons

Although CryptoTaxCalculator is free to try, you must pay if you want to produce a tax report.

The transaction limit on your plan will also cover transactions from prior financial years, even if a CryptoTaxCalculator subscription allows you access to all fiscal years.

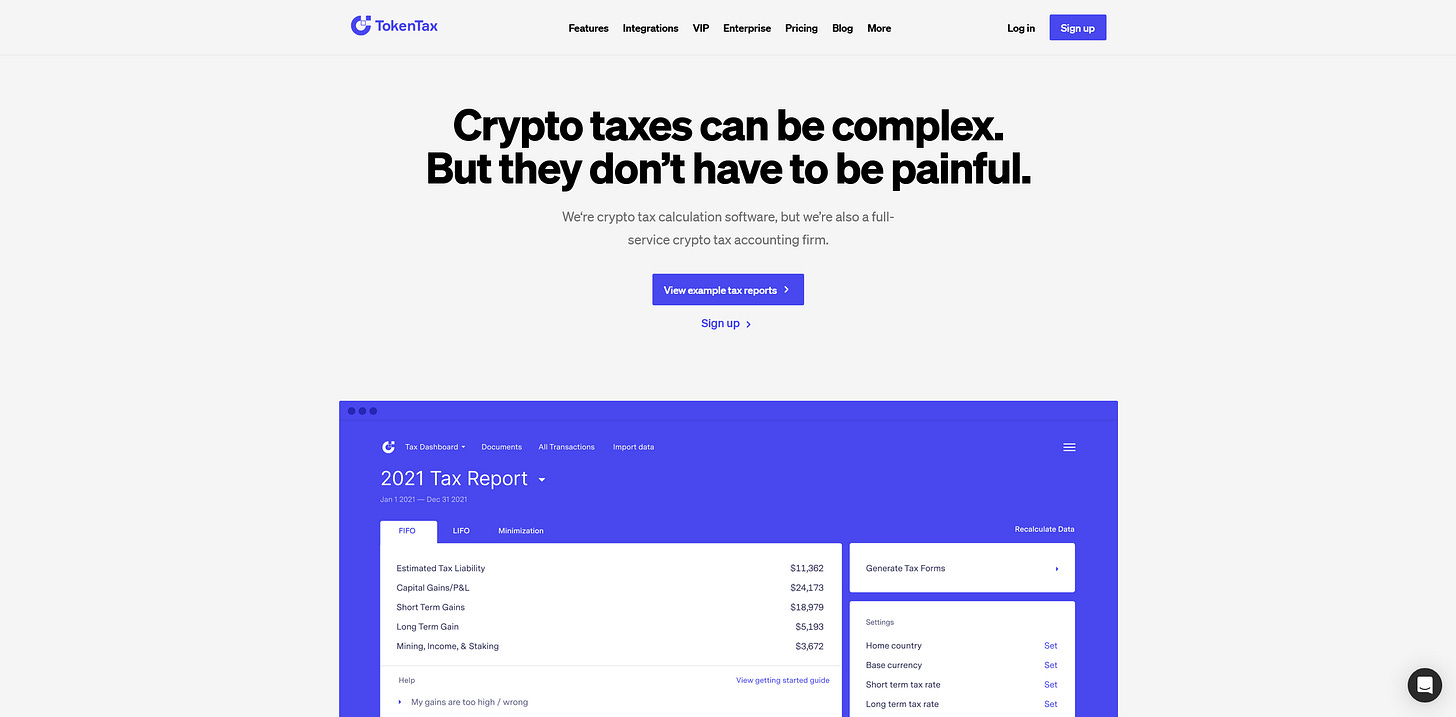

TokenTax

TokenTax is a crypto tax software where you can manually add your trades regardless of the exchange, even though it only supports roughly 120 exchanges and wallets through API and CSV uploads.

Pros

Although TokenTax only has roughly 120 integrations, its staff will make sure that your trades are recorded in your transaction history if you supply a CSV from any unsupported exchange.

For Premium plans and higher, you will receive advice on how to lower your tax obligations.

Integrations for certain DeFi protocols and NFT marketplaces are available in the Premium and Pro subscriptions.

Cons

The major drawback of TokenTax is its cost. With competitors like ZenLedger and Taxbit offering limitless transactions, TokenTax's $3,499 VIP package, which is the most expensive so far, only covers 30,000 transactions.

TokenTax doesn't provide refunds since it will take any necessary measures to ensure that your cryptocurrency tax data is accurate.

Contains only Form 8949. Any other tax forms, such as Schedule D, must be completed on your own.

Conclusion

Taxes on cryptocurrency are comparable to those on conventional assets. Either it is income or it is a capital gain (or loss). However, the regulations for conventional investments aren't necessarily the same, and there are frequently a lot more transactions for crypto users.

When tax season arrives, using specialized crypto tax software or dealing with a crypto CPA can simplify your activities. Your most dreaded situation might not be as horrible as you think.