Introduction to Solana

What to expect?

What is Solana?

The team behind it

Proof of History (PoH)

Decentralization

Scalability

Ecosystem

Top DApps

Sol Token

Final Notes

What is Solana?

Solana is an L1 blockchain that offers high throughput. Especially after the collapse of FTX and Alameda, the continuous development by the ecosystem's developers has secured it an even more significant position within the community. Choices like Proof of History (PoH) are highlighted in Solana's architecture. Additionally, Solana hosts a wide range of applications due to its high transaction capacity. Currently reaching an average of 3000-4000 transactions per second (tps) and having found a significant role in the DeFi ecosystem, let's take a closer look at Solana.

The team behind it

The project was established back in 2017 by Anatoly Yakovenko, who worked at Qualcomm before founding Solana. Before that, he worked at Dropbox as a software engineer.

Accompanying him are Eric Williams and Solana’s CTO, Greg Fitzgerald. They created a brand new process of dealing with traditional throughput problems that existed on Bitcoin – and then also on Ethereum.

PoH

As mentioned initially, Solana uses the PoH mechanism within its consensus. However, it should be known that PoH is not directly a consensus protocol or a Sybil attack mechanism. What PoH actually introduces is a way to keep “time” among nodes. This allows nodes to move together in unison and transactions in the network to be sequenced and processed in certain steps. Proof of History is essentially an update to Proof of Stake; it doesn't replace it entirely as a consensus mechanism.

If you want to learn what Proof of History is with a simple analogy, you can watch the short video below:

Decentralization

Verifying transactions on the Solana network is costly in terms of the computational operations required. When you look at the minimum hardware requirements, you see figures like 12 cores/24 threads for CPU and 256GB for RAM. Of course, these hardware capabilities allow Solana to reach a much higher transaction capacity, but naturally, the number of nodes in the network is lower compared to networks like Ethereum, which have lower minimum requirements. At the time of writing this article, there are 2912 nodes on Solana. When we look at the data on the Ethereum side at the same time, we see that there are 6991 nodes.

It's not easy to say that measuring decentralization is straightforward, but the number of nodes is definitely an important metric in this regard. Other important metrics to consider include the geographical distribution of nodes, whether nodes are installed on individuals' personal devices or on servers, and how many nodes are held by companies or institutions.

Scalability

Scalability is an important issue for all networks because, in short, it means that regular users can comfortably make transactions within the network at reasonable costs. Since its launch in 2020, Solana has indeed been promising to easily process transactions on its chain as a response to Ethereum's high base fees. It still manages this aspect well. To make a simple comparison with Ethereum, the average transaction fee paid by Solana's users in the last epoch was 0.000054925 SOL ($0.005), whereas, in Ethereum, the average transaction fee is 0.0008 ETH ($2).

Aside from this current data, in 2021, during Ethereum's congested times and various seasonal activities like the NFT boom, Solana became an escape for low-capitalized individuals who couldn't afford Ethereum's high costs. Laughing during a hyped NFT mint on Ethereum could cost you a few hundred dollars 😁. However, we should see what happens after the upcoming EIP-4844 and how it will affect the chain.

Also, when talking about scalability, on the Ethereum side, Ethereum serves as a settlement layer built upon by main Layer 2 solutions. According to L2Beat, there are currently 39 active Layer 2s 🤯. Solana's stance on this issue, as stated on the project's homepage, is: “Never deal with fragmented Layer 2 systems or sharded chains.”

Ecosystem

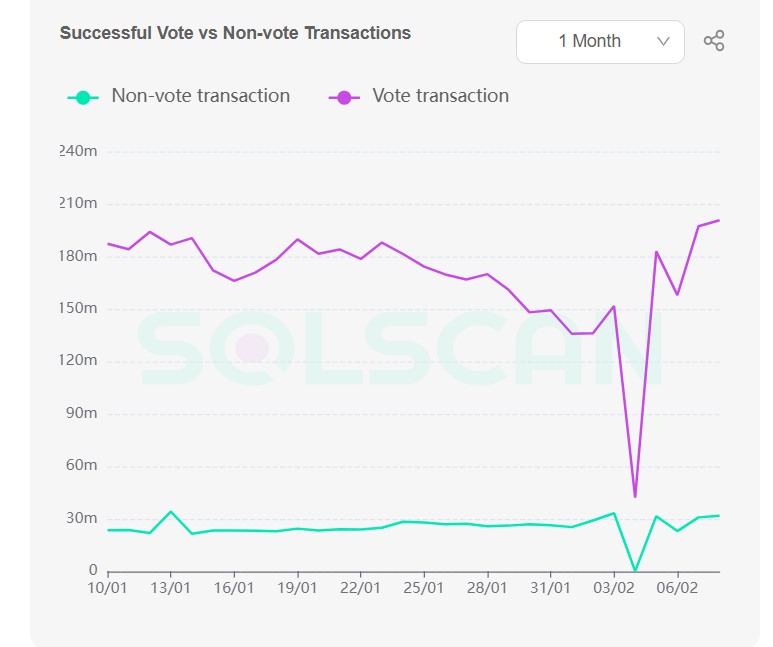

If you look at Solana's ecosystem page right now, you'll see that there are more than 600 applications on Solana. Excluding the recent downtime (which nearly made Solana's blockchain uninterrupted for 365 days, unfortunately becoming a bit of a setback for the community), Solana has still seen a high amount of transactions in the last 30 days. You can view the details in the table below.

So, in such a busy, affordable network, what's the state of the applications in the ecosystem? Which applications are popular and what categories do they belong to?

Top DApps

Orca is an advanced protocol built around a Concentrated Liquidity Automated Market Maker. It currently leads among DEXs on the network with over $150M in liquidity.

Other notable DEXs include: Raydium, Jupiter, and Serum. Of course, there are many more DEXs beyond these.

Pyth Network is an oracle protocol that connects the owners of market data to applications on multiple blockchains. Pyth's market data is contributed by over 90 first-party publishers, including some of the biggest exchanges and market making firms in the world. Over 100 protocols on 20+ blockchains trust Pyth to secure their applications.

Other worth mentioning analytic tools: Step Finance, Umbrella.

Marinade Finance is a stake automation platform that monitors all Solana validators and delegates to the best-performing ones. It is the number 1 protocol compared to other staking service apps.

Other worth mentioning staking apps: Jito, BlazeStake, and Jpool.

Magic Eden is the most popular NFT marketplace on Solana, which is now multichain.

Other worth mentioning NFT markets: Exchange.art, Solsea, and Solanart.

Besides, there are various high-user gaming applications like the move-to-earn concept's OG app, StepN, or StarAtlas.

Sol Token

Solana's native cryptocurrency, $SOL, has the following main use cases:

Transaction Fees: SOL tokens are used on the Solana network to cover transaction fees and smart contract operations, encouraging validators and ensuring network efficiency and spam prevention.

Staking: Users can stake SOL tokens to support the Solana network's operation as part of its Proof of Stake (PoS) consensus mechanism.

Validator Rewards: Validators receive SOL tokens as rewards for maintaining the Solana blockchain, incentivizing honest and efficient network performance.

Storage Payments: SOL tokens are used to pay for data storage on the Solana network, highlighting the token’s importance in supporting blockchain operational needs.

Final Notes

Solana is definitely one of the big players in the ecosystem, and having overcome a significant crisis, some see this as akin to Ethereum strengthening after the DAO Hack. Moreover, the strengthening of DeFi Applications on it makes the ecosystem stronger. Also, wide-scale airdrops by applications like Jupiter show metrics of many users from other networks moving to Solana. The Solana ecosystem seems to continue growing non-stop. If you want to follow these developments more closely and monitor the entire ecosystem through just one dashboard, you can check out our dashboard.