Currencies rise and fall, lose value, and are even taken out of circulation often, but with Bitcoin, we see a new dynamic, a (crypto)currency with a fixed supply. Bitcoin may appear infinite often, but there will only ever be 21 million Bitcoins units.

Surprised? Don't be. About 90% of Bitcoin's lifetime supply, accounting for 19 million Bitcoins, has been mined, with 2 million units left to be mined.

To this end, the Bitcoin protocol is programmed to help control the number of new coins issued with each new block using the process known as halving.

What is Bitcoin Halving?

Every four years, A Bitcoin Halving happens. This process helps ensure that Bitcoin retains its value over time. When this happens, the Reward for Bitcoin mining is slashed in half.

This is a key component of the master plan to ensure that Bitcoin's supply remains fixed at 21 million units and as a ploy to prevent inflation.

Unlike other fiat currencies, Bitcoin is keen on having a steady but limited supply, and to achieve that, the halving policy has been programmed into Bitcoin's mining algorithm.

How Does Bitcoin Halving Work?

No matter how little or how large a transaction takes place on the Bitcoin blockchain, it is verified by a decentralized group of validators. The process by which they validate these transactions is called mining. Simply put, this mining process involves miners adding a block to the chain.

Miners compete for who can add the next block – A file of Bitcoin transactions- onto the Bitcoin Blockchain.

To add this next block, they will need to solve difficult mathematical problems/cryptographic puzzles using specialized hardware at the cost of high energy usage. Electricity levels needed to mine often peak as high as 94.2 terawatt hours of electricity per year.

While competing, the goal of miners in the network is to be the first to get the correct answer to the question asked or to be the nearest to the correct answer(in a case where none of the miners in the network could crack the puzzle). Miners are tasked to make as many guesses en route, getting the target hash(a 64-character output) in the quickest time possible.

When a Bitcoin is successfully mined, the lucky miner gets a predetermined amount in the form of newly created Bitcoins, a value now pegged at 6.25BTC. The mining reward is halved for every 210,000 blocks added to the chain.

At a rate of a new block every 10 minutes, It takes four years to generate that amount of blocks inferring that Bitcoin halving occurs every four years. The last halving, which happens to be the third ever, took place in May of 2020, and if the timeline stays this way, we will have the next halving event in 2024.

Why Does Halving Happen?

This a question for the curious mind. As we mentioned, the Bitcoin mining algorithm is set to add a new block to the chain every 10 minutes.

As the network of miners expands, this time frame reduces slightly as the more miners there are, the stronger the hashing power.

While the average time to find a block often hovers around 9.5 minutes when more miners join the network, the mining complexity is re-adjusted once every 14 days to keep the 10-minute benchmark intact.

Bitcoin's supply will stop when it reaches 21 million units; halving shows that the amount of Bitcoin that can be mined with each block created reduces.

This will make Bitcoin rare and boost its purchasing power, a feat that would align with the plans of its founding fathers, who had the vision of a deflationary currency in mind when creating it.

Whether that goal has been achieved already is debatable. However, one thing is certain: Bitcoin halving has ensured that every unit of Bitcoin still in circulation is even more valuable than it once was before halving, trumping fiat currencies like U.S Dollars by gaining even more purchasing power over time.

Another theoretical way of viewing Bitcoin halving is by seeing it from the lens of the cryptocurrency's founding fathers, who thought of introducing halving to ensure an increased market flow of the coin Early on to help bring even more miners aboard the Bitcoin network.

Bitcoin Halving Timeline Thus Far

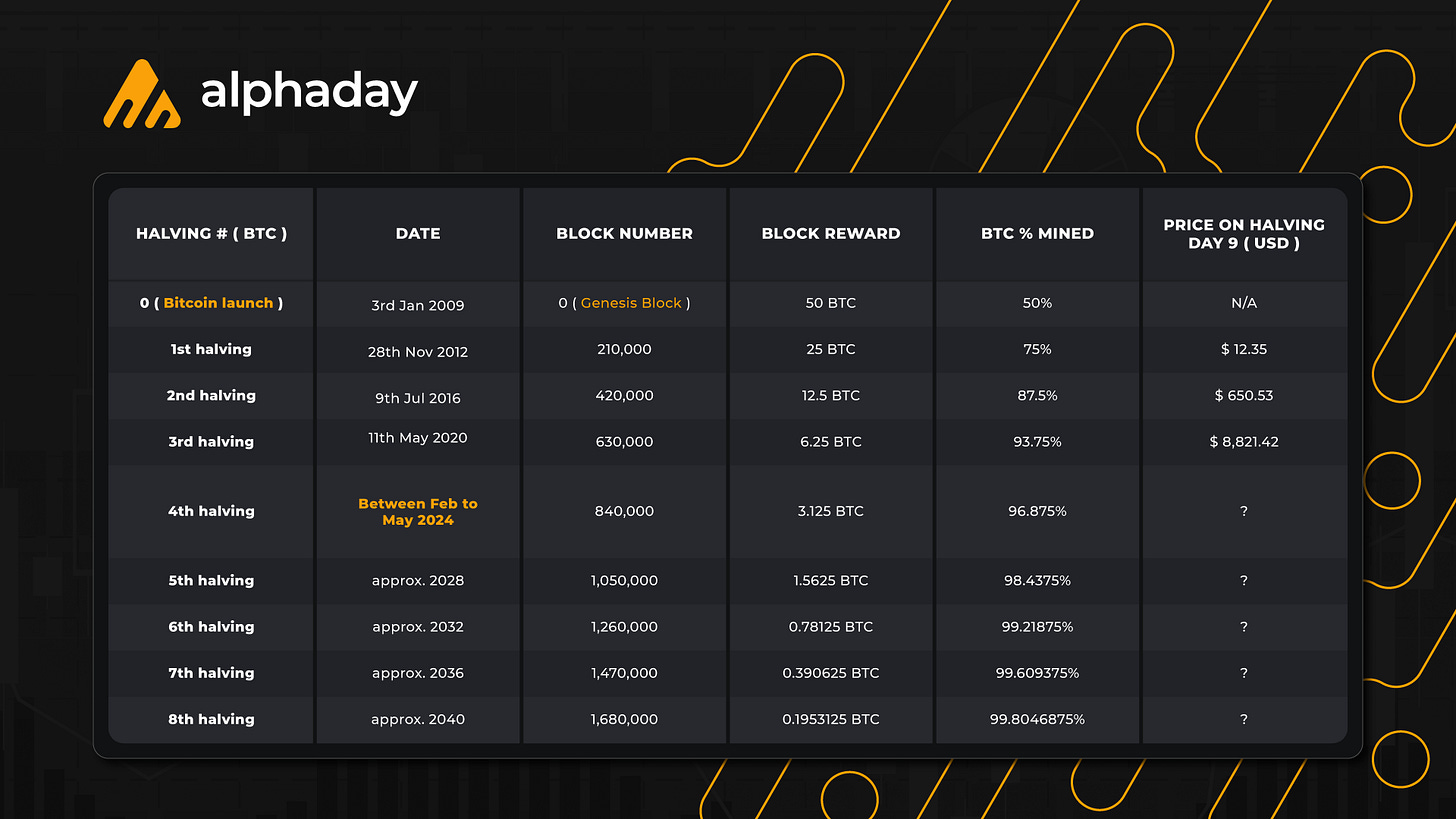

The first Bitcoin halving occurred in November 2012, and the second happened in July 2016, with the third being the most recent in May 2020.

The reward for mining was originally 50BTC per block as when Bitcoin was released in 2009. Over time, that number has dropped with every halving event and is currently at 6.25BTC.

First Halving:

This happened in November 2012, with the price of Bitcoin at 11 dollars. The price of Bitcoin soon went up a hundredfold after this, with mining rewards dropping to 12.5BTC.

Second Halving:

The second installment, July 2016: The Bitcoin network had 420,000 blocks, which prompted the second Halving event.

The then price of Bitcoin was in the range of $500-$1,000, with the exact price on halving day being $650.53, and it went on to eclipse $20,000 by December of 2017. The mining rewards dropped to 12.5 BTC after this.

Third Halving:

Coinciding with a bull market, the third Halving event happened in May 2020. Bitcoin, at this stage, was trading at only $9,000 but soon went up to as high as $30,000 by the end of that year. The mining rewards also dropped to 6.25BTC After this.

In totality, there will only ever be 64 halvings, with the last one projected to be in 2140.

By then, the full complement of the 24 million Bitcoin units will be in circulation, and no more coins will be created. Miners will remain paid, though, not with new BTC units but with transaction fees.

When will be the next Bitcoin Halving Event?

There isn't an exact date; there are only projections for now. The leading forecast is for the next event to occur in May 2024, four years after the last event in 2020.

Experts have hinted that the predictability of Bitcoin halving events is so that the network doesn't get shocked when they happen.

Despite this, other experts have sounded cautious about the next Bitcoin halving event, saying that although the price could appreciate, the costs could also tilt due to reduced mining activity.

Will Bitcoin go extinct after we exhaust the 21 million units?

No, it won't. By 2140, after which the last halving would have happened, block rewards would cease to be in the form of Bitcoins.

Instead, miners will be rewarded with transaction fees aggregated from network users. This is designed to serve as an incentive to ensure that more transactions go on, on the Blockchain.

Manage your Cryptocurrency News & Information all in one place

Alphaday is the ultimate crypto dashboard for staying up to date with all things crypto and interacting with your favorite DApps.

It is built on a highly customizable platform that lets you re-create your entire crypto workflow within minutes so you never have to visit another crypto website ever again.

Our mission is to bring you all the tools needed to follow your favorite projects, stay up-to-date with the latest narratives, and use your favorite dapps, all from the comfort of one easy-to-use customizable dashboard.

Conclusion

Bitcoin halving is an integral event in the overall programming of Bitcoin. While you may be content with investing in it, you must know a thing or two about this historical event that occurs every four years.

As an investor, you also need to be aware that this event affects the price of Bitcoin by causing significant fluctuations.

So if you are a potential investor or already have some dollars into Bitcoin, keep an eye out for 2024 when the next halving happens; it is sure to bear significance for the future of this highly volatile cryptocurrency.