You can't hear the word "Bitcoin" without "Ethereum" also being mentioned. It's one of the oldest blockchains in existence. It has more venture capital than any other chain. More projects. And holds on to the largest market cap by far.

So what is Ethereum? How does it work? How can users invest with it, and what do we mean by "projects"? Keep reading to have all of these questions (and more) answered.

Ethereum Basics

Ethereum isn't just a blockchain. It's a decentralized platform that runs smart contracts. These contracts are basically some code that runs exactly as programmed without any possibility of fraud or third-party interference.

The Ethereum protocol and its blockchain have a price for each operation or transaction fee, usually referred to as "gas".

The general purpose of Ether, Ethereum's token, is to pay for computation within the Ethereum Virtual Machine (EVM). It is used to pay transaction fees, pay for miner rewards before the merge, and as a general unit of account.

One Ethereum blockchain transaction can take seconds, whereas Bitcoin transactions can take up to an hour or more. Ethereum's popularity has grown exponentially over the years.

The initial success was primarily due to the Initial coin offering craze. ICOs are a way for companies to raise money by issuing their own digital tokens in exchange for investment.

They work similarly to the way IPOs work on the stock market. Every new token ran an ICO for a couple of years, and Ethereum was the favorite chain for new projects to release.

Despite this success, many challenges still need to be addressed to make Ethereum mainstream. These include scalability issues, privacy concerns, and the high cost of ETH transactions.

How Does Ethereum Work?

To run smart contracts and decentralized applications, or dApps, Ethereum utilizes a blockchain, a publicly visible ledger of all transactions that have ever occurred on the network.

The Ethereum blockchain is unique because it allows users to create their own applications, which run on the network and can be used by anyone. This makes Ethereum a potent tool for building decentralized applications.

The entire network recently moved from a proof-of-work model to a proof-of-stake model. This event, which was years in the making, was called The Merge.

Proof of Work (POW) VS. Proof of Stake (POS)

In a Proof-of-Work system, miners compete to validate transactions and add them to the blockchain. The first miner to validate a transaction and add it to the blockchain is rewarded with cryptocurrency.

In a proof of stake system, validators stake their cryptocurrency to validate transactions and add them to the blockchain. The more cryptocurrency a validator stakes, the more likely it will be selected to validate a transaction. If a validator validates a transaction and adds it to the blockchain, they are rewarded with cryptocurrency.

Both systems have their own advantages and disadvantages. Proof of work is more secure because it is more energy intensive and thus more expensive to 51% attack. However, Proof-of-Stake is more scalable because miners do not need to compete for rewards.

In addition, proof of stake does not require as much energy, which makes it more environmentally friendly. Ultimately, both systems have their own advantages and disadvantages, and which one is used depends on the project's specific needs.

Since its inception, Ethereum has operated on proof of work. As of The Merge, it is now on proof of stake.

The Merge

The Merge was executed on September 15th, 2022. Despite a Y2K-like atmosphere surrounding the official date, with many investors unsure what would happen, The Merge occurred with a few hiccups, and the network continues to run smoothly. It is now using 99% less energy.

Unfortunately, the miners had to find new homes with other tokens like Bitcoin and Dogecoin.

What Are the Benefits of Ethereum?

There are more pros than cons when it comes to Ethereum. Yes, hacks can and do happen. Yes, gas can be expensive. But let's examine why this chain is so good and what benefits the die-hard investors are reaping from it.

If Bitcoin Is Gold, Ethereum Is the Dollar

Bitcoin may have been the first kid on the block. There is a set amount in existence. As of writing this, the price is low, but many investors have stated on social media they foresee six-figure prices when we hit the next bull cycle.

Ethereum is printable. The Ethereum foundation can create more ETH whenever they feel it's necessary. If the gas gets too high, they can print more. If there is an influx of new users, more ETH can be printed. It's incredibly versatile because of this feature.

It's the Number One Network for NFTs and Defi Applications

The two hottest topics in the space right now are NFTs and Defi. Non-fungible tokens are unique digital assets that represent real-world objects or ideas. The most popular use case for NFTs is in the gaming industry, where players can own in-game items that are one of a kind.

Defi, or decentralized finance, is a way to use blockchain technologies to create financial applications that are not controlled by any central authority. Defi applications can be used for anything from lending and borrowing to trading and investing.

Ethereum is the perfect platform for both NFTs and Defi applications because of its decentralized nature. These applications can be built on Ethereum and run without any central authority.

It's Still Early

Despite all the progress Ethereum has made in the past few years, it is still early days. Many applications have not been built yet. The possibilities are endless.

Ethereum is now POS. We're possibly in the nastiest bear market in crypto history so far. Now is an excellent time to get in on the action and start accumulating while the token is reasonably priced. Remember, time in the market always beats timing the market.

It Has the Most Venture Capital Funding

Ethereum has more venture capital funding than any other cryptocurrency. That's because VCs know this is the most promising project in the space. They have poured billions of dollars into Ethereum startups and will continue to do so.

In the last two years, nearly $50 billion in funding has been invested into Ethereum.

These are just a few of the reasons why Ethereum is so popular. It is a versatile platform that can be used for various applications. It is well-funded, and it has a bright future ahead. Ethereum should be at the top of your list if you're considering investing in cryptocurrency.

What Are the Risks of Ethereum?

While Ethereum has many potential use cases, it also comes with some risks. One of the most significant risks is security. Because it's based on blockchain technology, it is potentially vulnerable to hacking.

In addition, Ethereum is still a relatively new platform, meaning it has not yet been thoroughly tested. There is a possibility that bugs or vulnerabilities could be discovered in the future.

Another risk to consider is price volatility. Like all cryptocurrencies, Ethereum is subject to wild fluctuations in price. This can make it difficult to predict the value of Ethereum in the future and lead to losses if the price falls sharply.

Finally, it's important to remember that Ethereum is not regulated by any government or financial institution. This lack of regulation makes Ethereum a risky investment for some people.

How to Buy Ethereum?

CeFi

You can easily buy ETH on a centralized exchange such as Gemini or Coinbase. Some exchanges operate their own blockchains, so you'll be purchasing a wrapped ETH, which will read wETH, as opposed to native ETH. The best example of this is probably Binance.

Native Tokens VS. Wrapped Tokens

Native tokens are the native asset of a given blockchain, such as Ethereum's ETH or Bitcoin's BTC. Wrapped tokens are ERC20 tokens representing another asset, such as wBTC (wrapped Bitcoin) or wETH (wrapped Ethereum).

There are benefits and drawbacks to various token types. Native tokens generally have better liquidity and price discovery, as there are more buyers and sellers of the asset.

However, wrapped tokens can offer greater flexibility, as they can be traded on any platform that supports ERC20 tokens.

For example, you can buy ETH on Coinbase, as that platform works on the Ethereum blockchain. But Bitcoin doesn't exist on that chain. So to buy Bitcoin on Coinbase, you have to purchase wrapped Bitcoin. What you buy isn't BTC. It's wBTC.

When you transact on the Ethereum blockchain, you pay gas fees in ETH. But if you have funds on Fantom, you would have wETH and instead pay your gas fees in FTM, and the amount of wETH in your wallet wouldn't change.

DeFi

Defi, on the other hand, stands for Decentralized Finance. These projects are often built on Ethereum and offer more significant opportunities for returns, but they are riskier and less regulated. Nevertheless, many investors believe DeFi's potential rewards are worth the risks.

To purchase ETH in a decentralized way, you first need to on-ramp funds to a centralized exchange and then move them into a DeFi wallet. The most popular one right now is called MetaMask.

So you on-ramp your USD to Coinbase, swap it for ETH, and then send it to your MetaMask account. Once a user has done this, they can take their tokens to any dApp on the network and use it however they see fit.

CeFi VS. DeFi

The above explanation can be confusing, so let's break it down more. There are two main types of Ethereum applications: Cefi and Defi.

These are the traditional players in the financial world, and they tend to be more regulated and less risky. However, they also tend to be less innovative and give fewer opportunities for returns.

CeFi apps are traditional centralized applications that run on Ethereum. They are built on top of the Ethereum blockchain and use it for transactions. However, they are not decentralized and subject to government and financial institutions' censorship.

Defi apps are decentralized applications that run on Ethereum. They are built on top of the Ethereum blockchain and are used for transactions. However, they are not subject to censorship from governments and financial institutions.

So, which one is better? It depends on what you're looking for. If you want a censorship-resistant and decentralized app, then Defi is the way to go. However, if you're looking for a faster and more user-friendly app, then Cefi might be a better option.

It's up to each user to decide which camp is right for them. If you're looking for stability and lower risk, CeFi may be the way to go. But if you're willing to take on more risk in pursuit of greater rewards, Defi could be the better option.

Wrapping It Up (Pun Intended)

Ethereum is a platform and blockchain that runs smart contracts, allowing builders from across the globe the ability to create their own projects and host them on the network.

These applications can have a variety of uses, including but not limited to finance, governance, voting, and more.

The Ethereum network has seen significant growth over the past few years. As more people use Ethereum for transactions and development, the value of ETH will likely continue to increase.

This makes Ethereum a potentially profitable investment for those willing to take on the risk.

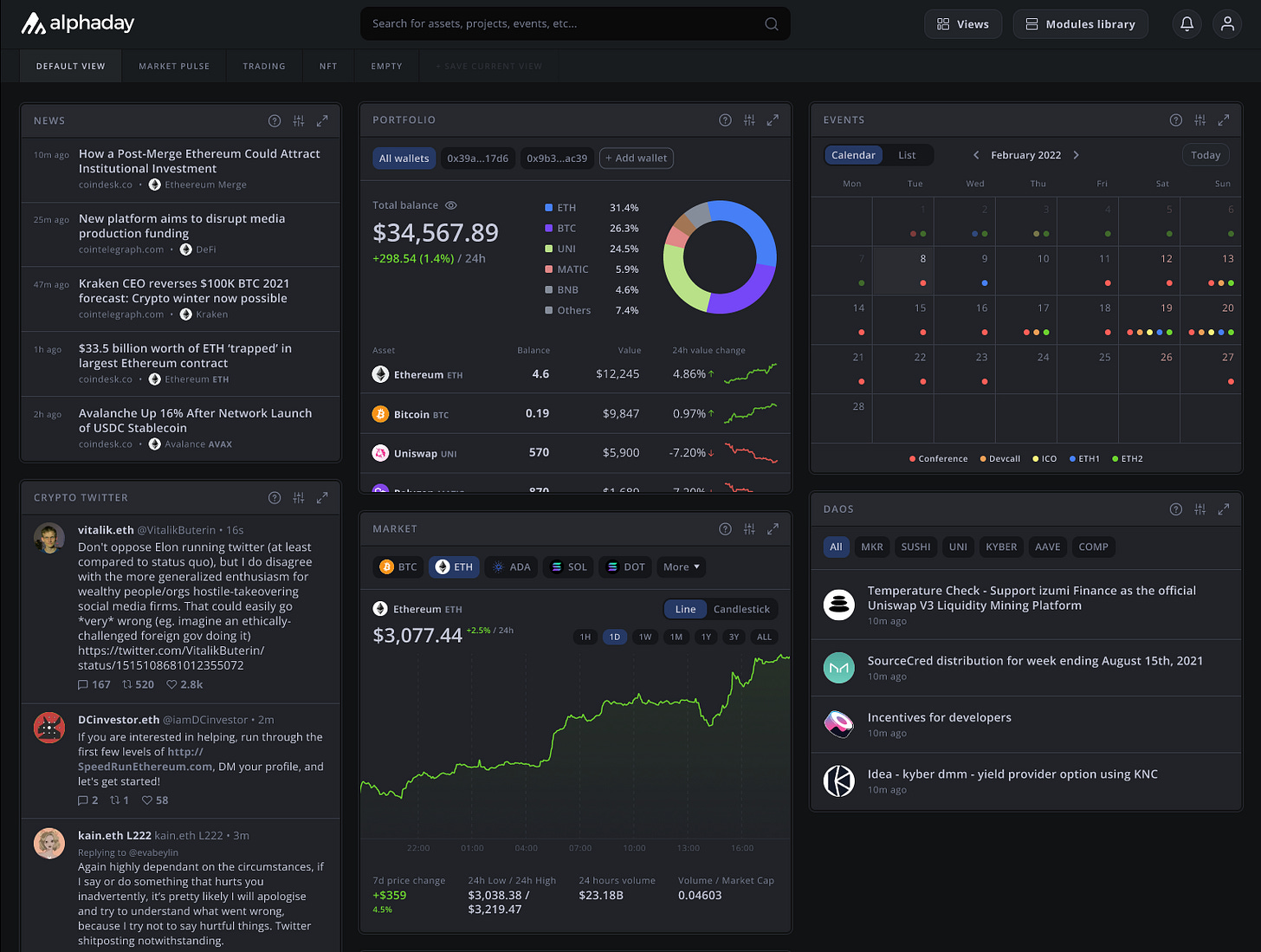

If you’re looking for a tool to keep you updated on Ethereum or other tokens, check out our free crypto dashboard tool!

Do you have any experience with Ethereum? Drop a comment below and give us your opinion on this blockchain and some of its dApps.

Citations

Forbes - An Overview Of Web3 Venture Capital Activity In 2021

Coin Telegraph - VCs pour $14.2B into crypto in H1 2022, but investments now slowing

Defi Llama - Chains