What do art lovers and crypto enthusiasts have in common? JPEGs.

NFTs, or non-fungible tokens, are all the rage right now, and for good reason. They offer a lot of potential for innovation in the world of blockchain technology. But what does staking have to do with them?

In this blog post, we will explore staking and how it relates to NFTs. We will also traverse through some of the possible use cases for staking NFTs and discuss why they are so exciting.

A Quick Overview of NFTs

A non-fungible token (NFT) is a digital asset that represents something unique and cannot be replaced.

Unlike traditional cryptocurrencies like Bitcoin, which are each interchangeable with each other, NFTs are meant to represent items like digital art, collectibles, or in-game items.

While they can be traded or sold like any other asset, their rarity can make them valuable in and of themselves. Because of their uniqueness, NFTs have been compared to physical assets like art or baseball cards. Like these items, NFTs can be bought and sold by collectors, and their value can fluctuate over time.

However, unlike physical assets, NFTs can also be used to unlock digital experiences or benefits. For example, some NFTs can be used to purchase virtual real estate or in-game items. Others may provide access to exclusive content or offer discounts on future purchases.

As digital assets continue to evolve, NFTs will likely play an increasingly vital role in the economy. And it can do so in multiple ways.

What Is Staking?

Regarding cryptocurrency, staking is the process of holding coins in your wallet to support the network. By doing so, you can receive rewards in the form of new coins. Staking differs from mining, which uses computational power to verify transactions and add new blocks to the blockchain.

Instead, staking relies on users remaining offline and keeping their wallets open to help validate transactions. In most cases, stakers will need to lock up their coins for a specific period of time in order to receive rewards.

However, some networks allow users to stake their coins without any minimum lock-up period. Staking is a popular way to earn passive income from cryptocurrency, and it often requires far less energy than mining. As a result, it has become an increasingly popular option for those looking to invest in digital assets.

If you receive email alerts from crypto projects, you may see emails hitting your inbox that promotes a new coin. It might say something like “Stake x token, get 12% APY”. It boils down to, at least in these cases, protocols needing deep liquidity for a particular token. In exchange, they offer higher-than-average APYs to entice users to add this liquidity to their projects or partnered projects.

It’s not a scam as long as the platform sending you emails is legitimate. Staking is both a standard and regular part of the crypto world. It helps platforms and users. However, high APYs are rarely sustainable and will drop quickly.

Scams do happen. Sometimes projects offer super degenerate APYs to attract new users, get a ton of liquidity, and then “rug” their own project, stealing millions of dollars in the process. That’s the risk you take in the world of defi and why it’s so important for you as an investor to vet projects before adding funds to them.

Staking and NFTs: Ultimate Two-Hit Combo?

Can you stake an NFT? The answer is yes, you can. In fact, there are several benefits to doing so. First of all, staking an NFT can help to increase its value. This is because staked NFTs are more likely to be traded and sold than non-staked NFTs.

Secondly, staking an NFT can help to secure its position on the blockchain. A staked NFT is less likely to be lost or stolen than non-staked NFTs.

Finally, staking an NFT can help to support the development of the underlying blockchain technology. Staked NFTs provide valuable resources that can be used to improve and scale the blockchain.

Types of NFTs

Collectibles are perhaps the most popular type of NFT, as they can be traded or sold like traditional collectibles, such as baseball cards or coins. Many people that enjoy what is known as “alternative investments” are drawn to crypto and defi in general, but have a particular affinity for collecting artwork, both digitally and traditionally.

Gaming items are another popular type of NFT, as they can be used to purchase in-game items or unlock new features. Certain NFTs of high rarity can open up increased gaming rewards, experience points, and other bonuses.

A financial NFT represents a financial asset. Like traditional security, an FNFT can be bought and sold on exchanges, and individuals or institutions can hold it. However, unlike a conventional investment, a financial NFT exists on the blockchain, which offers several advantages.

For one, blockchain-based assets are more secure and transparent than traditional assets. They are also easier to trade and manage because they are stored on a decentralized ledger. As a result, financial NFTs can potentially revolutionize the world of finance.

NFTs provide a unique and convenient way to store and trade digital assets. As the technology continues to evolve, we can expect to see even more innovative uses for these tokens.

Examples of NFT Staking

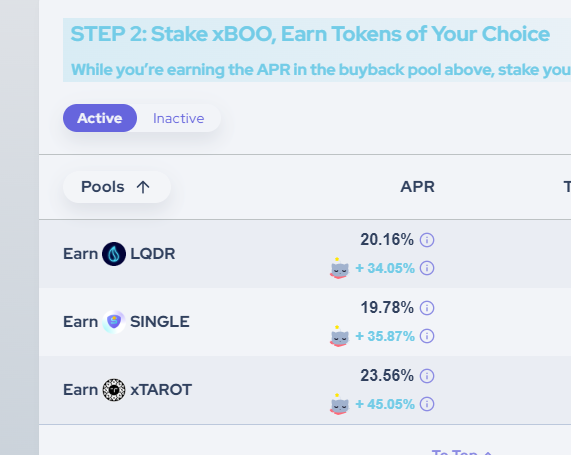

Spookyswap, over on the Fantom blockchain, allows owners of their NFTs, called Magic Cats, to stake them for additional rewards if they are an xBoo holder. Non Magic Cat holders will receive the standard APR, and each NFT owned and staked will substantially increase the rate of return.

Five thousand NFTs were minted, and the entire project was sold out in five minutes. However, users can purchase them on Paintswap, which is the major NFT auction house on Fantom.

One of the many benefits of financial NFTs is they can take illiquid assets and make them liquid. For example, if a project operates on a locking curve style model, the locked tokens can be minted into an FNFT and sold on the open market. These tokens will function exactly as they would if they were traditionally locked, including receiving rewards.

Revest Finance is one example that currently creates these NFTs for protocols, but others exist.

In the GameFi ecosystem, many in-game objects are NFTs that can be used during gameplay or sold to other players. Some games let users increase their value by levelling up or reaching new records and finding and developing in-game assets like land, weapons, or character skins.

Conclusion

Staking an NFT can provide a number of benefits, including increased value, security, and support for blockchain technology. In addition, staking is a convenient way to store and trade digital assets.

But for investors, defi users, and art enthusiasts? NFT staking could be the factor that makes your portfolio hit all-time highs. Unfortunately, it also has the potential to do the exact opposite.

We recommend treating NFTs exactly how you would any other investment. Decide how much of your portfolio you want to be made up of these JPEGs and stick to it. If you want something new, then sell something old. Don’t get caught up in the FOMO.

Resources

Spookyswap - Magic Cats

Revest - FNFTs

Binance - Staking APR